GP-Led Secondaries Remain Center Stage: How They Work, Why They're Popular, & Case Studies

GP-led deal volume hit $71 billion last year, and one fund managed to raise a whopping $30 billion this year.

🛠️ What’s Broken with Many GPs Today

The best GPs, are the one’s who stand out from the pack because they prioritize discipline, foresight, and a deep understanding of what drives investor confidence. They know that consistently returning capital to LPs isn’t just a box to check; it’s a strategic advantage. These top-tier GPs recognize that trimming positions and locking in gains, even during market highs, can strengthen their portfolios and build long-term value. By skillfully leveraging the secondary market, they balance immediate liquidity needs with the broader goal of optimizing portfolio performance.

For LPs, asking the right questions is critical. One of the most telling inquiries? "How did you navigate the market in 2021, and what companies did you choose to sell?" This question uncovers not only the GP's decision-making process but also their ability to seize opportunities and deliver results in dynamic market conditions. Great GPs don’t just hold assets and hope for growth; they act decisively, proving their value by knowing when to sell, reinvest, and deliver for their investors.

Private Market Enthusiasts,

With GP-led deal volume having hit $71 billion last year, and one fund having managed to raise a whopping $30 billion as of January this year (2025), it’s clear that secondaries are continuing to take off in a big way.

Imagine holding a winning asset in a private equity fund, but the clock’s ticking on your fund’s lifespan. Or you’re an LP desperate for liquidity in a market where IPOs and M&A deals are stuck in the mud. Enter GP-led secondaries, the innovative solution where general partners (GPs) transfer high-potential assets to continuation vehicles, delivering liquidity for LPs and extended upside for GPs. In 2024, this market didn’t just grow—it exploded, and 2025 is set to be even bigger.

Increasing demands for liquidity and struggling IPO and M&A markets have created an attractive environment for these types of transactions. Once viewed with skepticism as "last resort" options for struggling funds, these transactions now represent sophisticated portfolio management tools embraced by top-tier sponsors. The private equity landscape is vast and ever-shifting, but one thing is clear in 2025 – GP-led secondaries are no longer just an alternative play. They're a powerhouse solution.

If you're a GP or a capital formation expert looking to stay informed (and ahead), subscribing to FundShare should be your next move. Why? Because we’re breaking down the fundraising landscape, share videos on fundraising best practices, and teach you AI fundraising tools that saves you time, share creative ways to provide value to investors, and stay on top of the latest LP investing trends.

🧐 What Are GP-Led Secondaries?

GP-led secondaries are a segment of the private equity secondary market where general partners (GPs) take the lead in managing liquidity solutions. Rather than relying solely on traditional exit routes like IPOs or M&A, GPs use these transactions to create continuation vehicles (dedicated follow-on funds) for holding high-performing assets.

This strategy allows GPs to extend their ownership of portfolio companies, secure further capital for scaling operations, and offer legacy limited partners (LPs) options for liquidity or reinvestment. With continuation funds making up 88% of all GP-led deal volume in 2023, the trend has become an essential tool in modern private equity portfolio management. (Source: CAIS Group)

🏗️ How They Work:

Continuation Vehicles:

The GP creates a new fund, often called a continuation vehicle, to hold one or more assets from the original fund. This allows the GP to extend the investment horizon for assets they believe have further growth potential.Liquidity for LPs:

Existing LPs in the original fund are given two options:Cash Out: Sell their stake in the fund and receive liquidity.

Roll Over: Reinvest their stake into the new continuation vehicle, maintaining exposure to the asset(s).

New Investors:

The continuation vehicle is often funded by new secondary investors who bring fresh capital. These investors typically negotiate terms based on the asset's valuation and future growth potential.Strategic Benefits:

For GPs: They retain control of valuable assets, secure additional capital for growth, and avoid a forced sale in unfavorable market conditions.

For LPs: They gain flexibility—either exiting for liquidity or staying invested for potential upside.

Why They’re Popular:

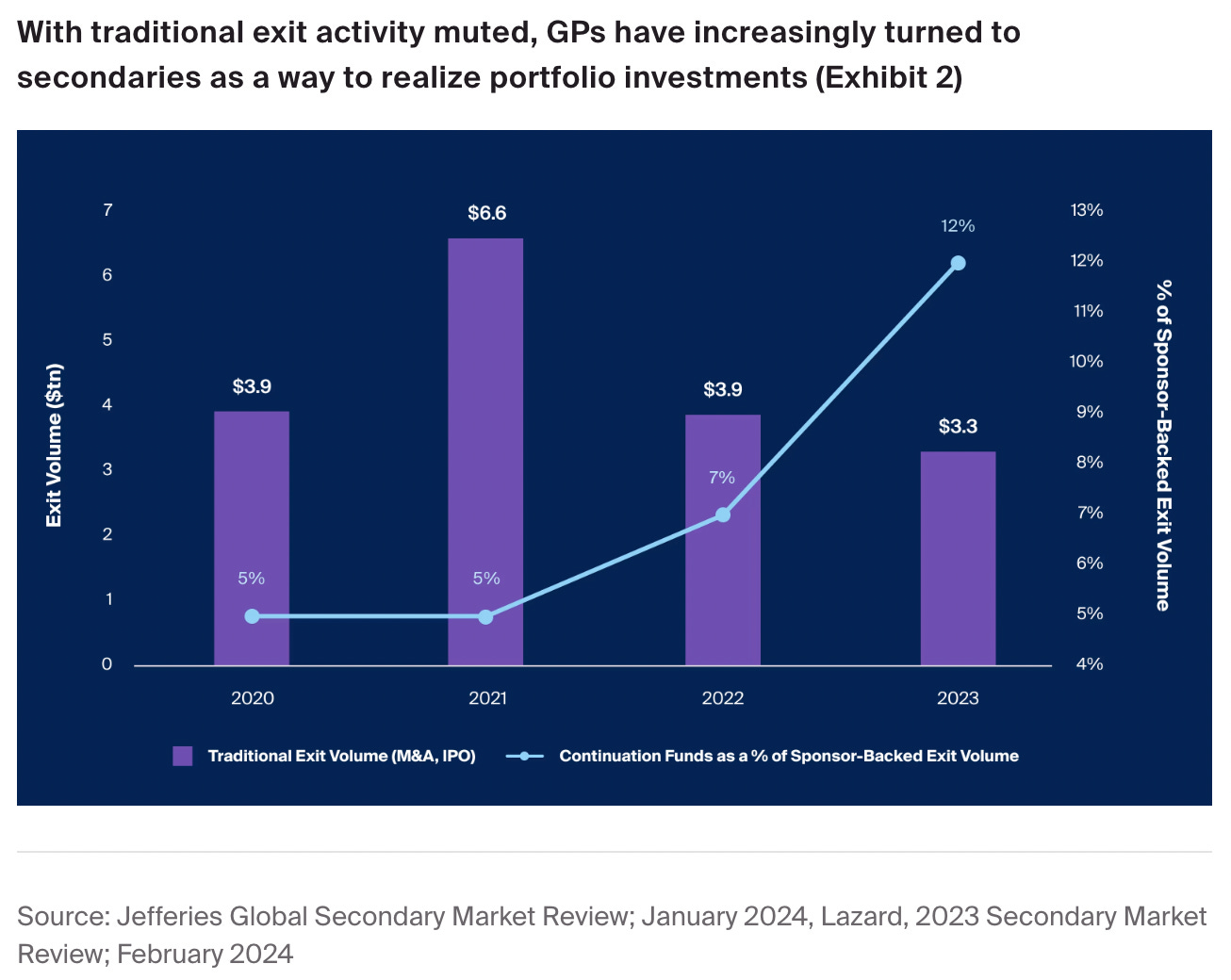

Market Challenges: With traditional exit routes like IPOs and M&A slowing down, GP-led secondaries provide an alternative way to realize value.

Asset Optimization: GPs can continue managing high-performing assets without the pressure of selling prematurely.

Flexibility: LPs can choose liquidity or reinvestment, depending on their needs.

In essence, GP-led secondaries are a win-win for both GPs and LPs, offering liquidity, flexibility, and the ability to maximize the value of private equity investments.

📊 GP-Leds Are Taking Center Stage

Today, GP-led secondaries are one of the fastest-growing alternative asset classes. GP-led transaction volumes have roughly quintupled over the last five years as primary PE fund managers seek to hold onto portfolio companies to continue creating value while offering greater liquidity to their limited partners (see below).

💥 What's Driving the GP-Led Secondary Boom?

The GP-led secondary market has exploded in recent years, with transaction volumes reaching unprecedented levels. Several factors are fueling this growth:

1. Extended Fund Lifecycles

As private equity hold periods stretch beyond traditional timeframes, GPs seek creative solutions to deliver returns while maximizing value for high-performing assets.

2. Value Creation Opportunity

Many sponsors recognize they haven't fully captured an asset's potential within the standard fund lifecycle and want additional runway to implement their value creation strategies.

3. LP Portfolio Management

Limited partners increasingly view secondaries as effective portfolio management tools rather than distress signals, allowing them to rebalance exposure or generate liquidity.

4. Specialized Secondary Capital

The emergence of dedicated secondary buyers with deep expertise has streamlined processes and created more competitive pricing environments.

🌟 Unprecedented Growth

Last year, the secondaries market achieved record-breaking transaction volumes of $160 billion. Of that, GP-led deals accounted for nearly 50% of total activity, with continuation funds alone contributing $71 billion. This remarkable growth highlights that private equity managers are no longer relying solely on traditional exit routes, such as IPOs or direct sales. (Source: CAIS Group)

Instead, savvy GPs are leaning into innovative strategies like multi-asset and single-asset continuation vehicles. Whether to retain high-performing assets or unlock liquidity for limited partners (LPs), GP-led secondaries are proving to be uniquely versatile.

🏆 A Win-Win for GPs & LPs

For GPs: These deals allow fund managers to hold onto "trophy assets" poised for future growth. It’s a chance to double down on winners by injecting fresh capital into businesses they believe will drive long-term returns. The 59% increase in multi-asset continuation vehicles in 2023 demonstrates their role in enhancing fund distributions and managing portfolios nearing maturity. (Source: CAIS Group)

For LPs: Investors gain flexibility. Whether opting for liquidity or rolling over their investments, LPs are being given options within a competitive pricing landscape. Continuation funds, in particular, offer value preservation by mitigating premature sell-offs. Capitalizing on liquidity or rolling over investments into new vehicles, LPs gain flexibility unavailable through traditional exits. LP pricing improvements, which rebounded to 85% of NAV in late 2023, have further supported LP participation in secondary markets. (Source: Jefferies Global Review)

For both sides, one fundamental force is at play here – alignment of interests.

💡 The Rise of the Continuation Fund

With 14% of all sponsor-backed exits now rooted in continuation vehicles, GP-led secondaries aren't just another market tool. They’re transforming fund economics and strategy as we know it. Through these vehicles, GPs secure time to further scale high-potential assets while LPs can choose between liquidity or deeper alignment with the portfolio’s future.

And importantly, as retail capital enters the equation (looking at you, ‘40 Act funds), the demand for these high-value secondary solutions only grows stronger.

In October 2024, Insight Partners closed a $1.5 billion continuation fund to acquire stakes in software companies across multiple Insight funds. HarbourVest Partners led commitments to the vehicle.

In another example, Vista Equity Partners sought to raise a continuation fund of $5 billion for portfolio company Cloud Software, according to reports in May.

📈 Key Trends for 2025

Increasing Fund Sizes, Sharpening Strategies

Secondary funds raised over $40 billion in the last 18 months alone. With top-tier managers strategically developing continuation funds, expect enhanced deal structuring this year. (Source: LGT Capital, 2025)Retail Capital in Secondaries

Registered '40 Act funds raised $5 billion in 2024, opening doors to retail investors eager for portfolio diversification and stable cash flow. This is expected to drive even greater momentum in secondaries. (Source: Torys Quarterly, 2025)Targeted Global Expansion

Western Europe, particularly mid-market hubs like the UK and Italy, is becoming fertile ground for growth in secondaries. ESG-related strategies are also on the rise, appealing to modern LP interests. (Source: Investec and CAIS Group, 2025)

🌱Continuation Vehicles: The Leading Edge

Continuation vehicles have emerged as the predominant structure in the GP-led secondary market. These vehicles allow managers to transfer assets from existing funds into new entities with fresh terms and capital. This approach delivers several advantages:

Extended Value Creation: GPs gain additional time to implement strategic initiatives

LP Optionality: Existing investors can choose to cash out or "roll" into the new vehicle

GP Economics: Managers can reset carry and potentially enhance their economic alignment

Fresh Capital: New investors can access vetted assets with established track records

⚖️ Navigating Complexity: Key Considerations

Despite their popularity, GP-led transactions require careful navigation:

Alignment of Interests: Ensuring fair treatment between rolling LPs, selling LPs, and new investors

Valuation Dynamics: Establishing appropriate pricing through competitive processes

Governance Framework: Creating effective oversight mechanisms for continuation vehicles

Regulatory Landscape: Adapting to evolving SEC scrutiny and disclosure requirements

🏛️ The 2024 Numbers You Need to Know

Unprecedented Volume: GP-led secondaries drove $75 billion of the secondary market’s record $162 billion in 2024, with continuation vehicles accounting for 84% of GP-led deals.

Exit Dominance: Continuation funds made up 14% of global sponsor-backed exits, up from 5% in 2021, proving their mainstream appeal.

Multi-Asset Surge: Multi-asset funds matched single-asset funds at 38–39% of GP-led volume, offering GPs flexibility to manage diverse portfolios.

Big Deals: 27 LP-led transactions exceeded $1 billion, with GP-led deals like those from Insight Partners and General Catalyst hitting similar scale in venture capital.

Pricing Power: Secondary pricing rose to 89% of Net Asset Value (NAV), a 400-basis-point jump from 2023, signaling strong investor confidence.

Dry Powder Boom: Secondary investors held $187 billion in 2024, projected to hit $216 billion in 2025, fueling larger and bolder deals.

🎯 What’s Next for 2025?

Bigger Funds, Bigger Ambitions

Secondary funds flush with fresh capital are intensifying competition for marquee deals. Expect strategic innovation in deal structuring to continue as sponsors maximize opportunities.Retail Capital Surge

Private wealth platforms are eyeing secondaries for their portfolio diversification and predictable cash flows. This layer of retail-driven demand could significantly influence pricing and volume trends.Global Expansion

Western Europe and untapped markets like Italy are emerging hotspots for mid-market GP-led deals. This geographic diversification aligns perfectly with growing applications in ESG-related strategies, tech, and healthcare.

Why This Matters to You

The private equity exit market is in a chokehold: M&A is down 61% and IPOs are off 80% from 2021 highs. With $3.2 trillion in unsold assets clogging buyout funds, GPs are turning to continuation funds to keep their best assets growing while giving LPs a way out. Whether you’re an LP seeking liquidity, a GP eyeing longer holds, or an investor hunting undervalued opportunities, GP-led secondaries are your ticket to navigating this gridlock. But here’s the catch: one-third of deals fail due to misaligned pricing or poor execution. Knowledge is your edge.

📚 Case Studies of Successful GP-Led Transactions

Keep reading with a 7-day free trial

Subscribe to Fundshare to keep reading this post and get 7 days of free access to the full post archives.