The Emerging Edge: How Consultants Are Betting Big on New VC Managers & What They Look For

Callan, GCM Grosvenor, and StepStone

Emerging managers, in particular, have demonstrated strong potential to generate superior returns. However, investing in them requires a sophisticated selection process, as institutional investors must navigate a crowded landscape where differentiation, execution ability, and alignment with LP interests matter more than ever.

Institutional investors and consultants recognize that true outperformance often comes from deeper diligence—understanding how managers source deals, win competitive investments, and drive real impact post-investment.

For decades, venture capital (VC) was considered an “access class”—where success depended on securing allocations in brand-name firms. However, as the market matures, the increasing number of funds, the growing importance of specialization, and shifting dynamics in venture investing have made manager selection both more complex and more critical than ever.

Why Emerging Managers? The Data Speaks for Itself

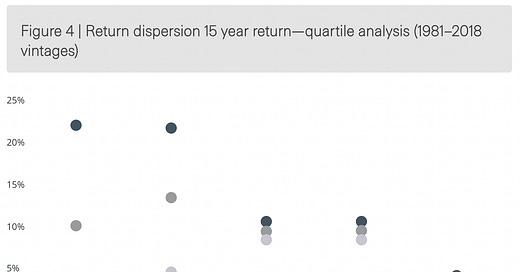

Institutional consultants like StepStone Group, Callan, and GCM Grosvenor have extensively researched VC performance trends. Their findings underscore a key insight: emerging managers consistently contribute to the upper echelon of venture returns.

StepStone Research: Data from StepStone’s proprietary SPI Research shows that approximately half of the top 10 performing venture funds in each vintage since 2001 were emerging managers—defined as firms that have raised three or fewer funds.

Fund Size and Performance: Smaller funds (under $500 million) tend to outperform larger funds, though with higher variability in outcomes. The ability of emerging managers to focus on smaller, overlooked opportunities has contributed to this trend.

GCM Grosvenor’s Experience: With over 20 years of investing in small and emerging managers, GCM Grosvenor has committed nearly $20 billion to these firms, recognizing their ability to generate differentiated returns.

While top-tier, established venture firms remain a staple in many institutional portfolios, the data suggests that emerging managers play a vital role in capturing alpha.

How Institutional Investors Evaluate Emerging Managers

Keep reading with a 7-day free trial

Subscribe to Fundshare to keep reading this post and get 7 days of free access to the full post archives.