Hamilton Lane & StepStone: Evergreen Funds To See Uptick—Why Now, What's Next & Potential Portfolio Benefits

Evergreen funds currently make up 5% of private markets, or about $700 billion.

🌱 Evergreen Funds: A Modern Solution for Private Market Exposure

As private markets continue to grow in both size and significance, investors are increasingly seeking structures that provide the long-term upside of alternatives—without the illiquidity, administrative complexity, or capital call cycles that traditionally come with closed-end funds. Enter evergreen funds: open-ended investment vehicles designed to offer ongoing access, built-in diversification, and institutional-caliber exposure with greater flexibility.

What Are Evergreen Funds?

Evergreen funds are open-ended investment vehicles with no fixed end date, allowing investors to enter and exit periodically, usually monthly or quarterly, and are accessible to accredited investors. They typically offer periodic liquidity windows (monthly or quarterly) and are accessible to accredited investors at lower minimums, often starting at $25,000, compared to the $5 million+ thresholds for traditional private funds.

This structure enables investors to enter and exit on a rolling basis, providing more dynamic exposure to long-term private assets.

🎥 Hear How StepStone Private Wealth Incorporates Evergreen Funds & the Questions to Ask

🌱 Reshaping Access to Private Markets for the Next Decade

Why institutions and allocators are leaning into the future of flexible private market investing.

According to Hamilton Lane's 2025 Market Overview, evergreen funds currently make up 5% of private markets, or about $700 billion, and are expected to grow faster than public markets over the next five years, potentially reaching 20% within a decade. Institutional investors are becoming bigger players, and fees may decline over time. Closed-end funds in some strategies are expected to fade, with larger firms growing at the expense of smaller ones.

In the traditional world of private markets, investors have long faced a frustrating tradeoff: either lock up capital for a decade in closed-end funds—or sit on the sidelines. But that paradigm is rapidly changing. Evergreen funds—flexible, perpetual investment vehicles—are stepping into the spotlight and delivering on a vision of access, liquidity, and consistency.

It's not just high-net-worth individuals driving demand. Institutional investors are actively reallocating into evergreen structures, combining them with drawdown funds to fine-tune exposure, improve liquidity profiles, and reduce portfolio friction.

Source: HamiltonLane

📈 What Makes Evergreen Funds So Compelling?

Evergreen funds allow investors to continuously subscribe and redeem (typically monthly or quarterly), while maintaining exposure to diversified portfolios across private equity, credit, real estate, infrastructure, and secondaries. They are built for long-term compounding, offering lower minimums (starting around $25,000) and immediate capital deployment, avoiding the notorious J-curve drag of traditional funds.

📊 Did You Know?

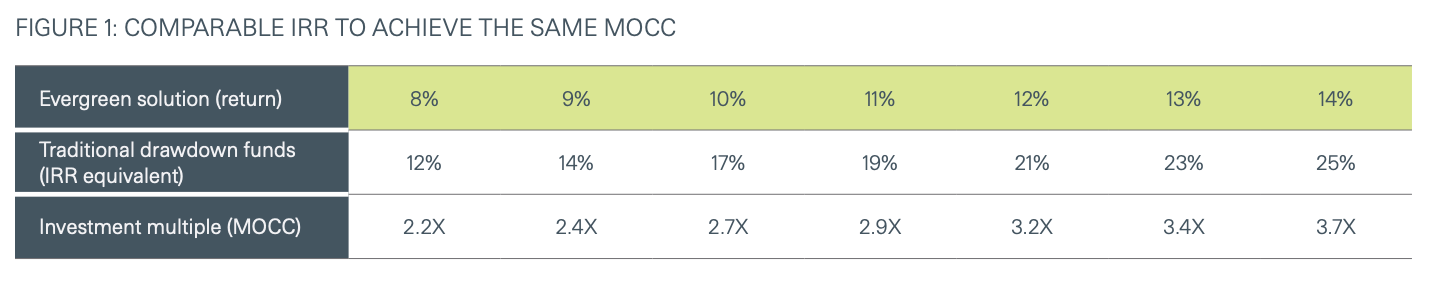

To achieve a 2.4x MOCC (Multiple on Committed Capital), a drawdown fund would need to generate a 14% IRR. An evergreen fund, by contrast, needs only 9%—thanks to full capital deployment from day one.

(StepStone Group, 2024)

This simple but powerful math highlights a key advantage: capital efficiency.

🔎 Why Now? The Institutional Case for Evergreen Funds

In a world of increased liquidity demands, fee compression, and technology-enabled transparency, evergreen funds offer an elegant solution to multiple investor pain points:

🚀 Immediate Capital Deployment

Unlike closed-end funds, evergreen vehicles invest capital immediately—no capital calls, no dry powder drag. This means higher MOCC (Multiple on Committed Capital) over time. In fact, a 9% evergreen return equals a 14% IRR in a drawdown structure (StepStone).

💼 Operational Simplicity

Evergreen funds eliminate vintage complexity. Investors stay continuously invested—no need to track capital calls, reinvest distributions, or monitor re-ups across multiple funds.

🔄 Built-in Liquidity

Periodic redemption windows (monthly or quarterly) allow dynamic allocation—essential for both institutional and private wealth portfolios. Liquidity buffers are typically maintained using private credit, secondaries, or short-duration real assets.

📊 Modern Transparency

With monthly NAVs and standardized reporting, evergreen funds offer real-time portfolio visibility, a growing priority for family offices, wealth platforms, and CIOs managing multi-asset portfolios.

🧠 “Firms successfully accessing the fundraising market today are those investing in technology and innovative investment structures that address the demands of new audiences.”

— Hamilton Lane, 2025

⚖️ Evergreen vs. Drawdown: Not a Replacement—A Realignment

While evergreen funds offer structural advantages, they are not a replacement for drawdown funds—but a complement.

According to StepStone, evergreen funds may deliver higher MOCC due to full capital deployment, while drawdown funds often optimize for IRR by focusing capital only on their core strategy. The tradeoff: evergreen funds carry a liquidity buffer, which can slightly dilute returns.

FeatureEvergreen FundsDrawdown FundsCapital DeploymentImmediate2–5 years (via capital calls)LiquiditySemi-liquid (quarterly)IlliquidMinimum Investment$25K–$250K$1M+ValuationMonthly NAVQuarterly reportsReturn ProfileOptimized for MOCCOptimized for IRROperational SimplicityHighComplex (calls, reinvestment)

💬 “Evergreen funds allow investors to avoid the J-curve by starting with a seasoned portfolio. Capital stays at work, continuously compounding.”

— StepStone Group, 2024

🧩 Portfolio Construction: Use Evergreen Funds as a Core Allocation

Today’s leading allocators are building hybrid strategies—with evergreen funds as the core, complemented by tactical allocations to drawdown funds.

🏛 Institutions are parking uncalled capital in evergreen funds to boost deployment rates, while maintaining exposure to high-quality, seasoned portfolios.

💼 Private wealth advisors and platforms are leveraging evergreen structures for ease of access, reduced admin burden, and more consistent client engagement.

🌱 New entrants to alternatives are finding evergreen funds a turnkey way to build long-term exposure without managing capital call complexity.

🧭 “Those new to private markets may find that the efficiency, simplicity, and transparency of evergreen funds provide a complete solution.”

— StepStone Group

🔮 What’s Next: Where Evergreen Funds Are Headed

Hamilton Lane and StepStone agree: evergreen funds are positioned to be one of the fastest-growing segments of private markets in the coming decade. Areas of focus include:

Private credit – A natural fit for liquidity management and yield-seeking portfolios

Secondaries – Providing vintage diversification and shorter duration

Growth & venture (AI, tech, healthcare) – Carefully structured evergreen vehicles can offer exposure to high-growth sectors

Infrastructure & real assets – Long-duration yield with inflation protection

🗺️ Strategic Allocation Guidance from Consultants

Evergreen funds are increasingly seen as core building blocks of alternative allocations—particularly when paired with closed-end strategies. Here's how investors are using them today:

For Tactical Liquidity: Evergreen credit and secondaries funds provide more predictable cash flows, allowing investors to better match liabilities or navigate market cycles.

As Core Private Market Exposure: Institutions are layering evergreen funds into the base of their alt allocations for stability and continuity, while using closed-end funds for more opportunistic or niche exposures.

To Reach Underserved Sectors: Areas like AI-enabled growth equity, U.S.-focused private credit, and infrastructure are increasingly packaged into evergreen formats by top-tier managers.

Risk Management: Consider the fund's ability to manage liquidity during market stress. Investors should understand the underlying investment strategies and their appropriateness for an evergreen structure, ensuring alignment with long-term objectives.

🧭 Investor Allocation Trends

📊 Institutional Investors Leading the Charge

Hamilton Lane 2025 Market Overview highlights a notable trend: institutional investors are becoming more prominent players in the evergreen space. The firm anticipates that evergreen funds will grow faster than the overall rate of public markets over the next five years, potentially accounting for over 20% of private markets within a decade . This growth is driven by the desire for structures that offer periodic liquidity, immediate capital deployment, and simplified operations.

💼 Private Wealth Embracing Evergreen Funds

The private wealth sector is also showing a strong inclination towards evergreen funds. Hamilton Lane's 2025 Private Wealth Survey reveals that nearly 60% of financial professionals plan to allocate 10% or more to private market investments in 2025, marking a 15% increase from the previous year . The appeal lies in the lower investment minimums, typically starting at $25,000, and the ability to access diversified private market portfolios without the complexities of traditional closed-end funds.

🌍 Global Expansion and Accessibility

To cater to this growing demand, Hamilton Lane has launched several evergreen funds, including the Global Private Assets Fund and the Private Infrastructure Fund for U.S. investors . These funds are designed to provide investors with diversified exposure to private markets through a single commitment, offering periodic liquidity and immediate capital deployment

📈 Why Evergreen Funds Now

Institutional allocators and sophisticated family offices are gravitating toward evergreen funds because they solve multiple pain points simultaneously:

✅ Portfolio Flexibility & Liquidity

Unlike traditional funds with 10–12 year lockups, evergreen funds offer scheduled redemption opportunities, giving CIOs and portfolio managers more control over pacing and rebalancing.

✅ Lower Friction, Faster Deployment

No capital calls. No J-curve. Capital is deployed immediately upon commitment, enabling investors to put capital to work and compound returns earlier.

✅ Continuous Exposure Without Reinvestment Risk

Evergreen structures recycle distributions into new investments, eliminating the reinvestment friction and administrative burdens that come with re-upping into new vintages.

✅ Diversified Access at Lower Minimums

With thresholds starting as low as $25,000, evergreen funds democratize access to private markets—while still offering institutional-grade strategies and sponsors.

📊 Potential Benefits for Investors

Evergreen funds offer several advantages that make them attractive for portfolio integration:

🔓 Accessibility: With lower investment minimums, typically starting at $25,000, evergreen funds are within reach for individual investors and those with smaller capital allocations, compared to the $5 million minimums for traditional closed-end funds. This accessibility is particularly appealing for accredited investors, broadening the investor base.

🔁 Liquidity: Periodic redemption options, often monthly or quarterly, provide investors with greater flexibility to adjust their portfolios as needed, addressing one of the main challenges of private market investments. This liquidity is achieved by investing some of the fund in assets with shorter durations, such as private credit, which deliver more predictable cash flows.

🌐 Diversification: Evergreen funds provide exposure to a diversified portfolio of private companies, spreading risk across sectors like private equity, credit, real estate, and infrastructure. In a fund of funds format, they offer indirect, diversified exposure, while in a direct format, they provide targeted exposure similar to closed-end funds, enhancing portfolio diversification benefits.

🧩 Simplified Portfolio Management: Investors can maintain consistent exposure to private markets without the need to continually reinvest distribution proceeds, as evergreen funds recycle profits into new investments. This structure allows for easier management of allocations, offering the opportunity to redeem capital or invest new capital on an ongoing basis, aligning with long-term investment goals.

An unexpected detail is the operational simplicity for investors, as they do not need to invest regularly in new funds; they stay in the existing one, reducing administrative burden and enhancing long-term commitment.

🔍 Looking Ahead: A Permanent Shift in Private Market Access

The growth of evergreen funds reflects broader trends in private markets, including increased demand for liquidity and accessibility, particularly among retail and individual investors. The doubling of evergreen funds from 2018 to 2023, as per Preqin, indicates a maturing ecosystem, with potential for further innovation in fund structures.

Hamilton Lane's emphasis on technology and transparency, with Mario Giannini stating:

"We believe that investors deserve high-quality data, actual transparency and continued education around this long-term asset class."

Looking ahead, the U.S. market is expected to be relatively more attractive than other geographies over the next 4-5 years, offering opportunities for evergreen fund allocations. Sectors like credit, infrastructure, and secondaries are set up for success, while venture and growth, particularly in AI, present high-growth potential, aligning with evergreen fund strategies for diversified exposure.

With new technologies, more investor-friendly terms, and demand for flexible structures rising, evergreen funds are becoming a critical tool in the allocator’s toolkit—poised to reshape the next decade of private market investing.

~ Fundraising Futurist